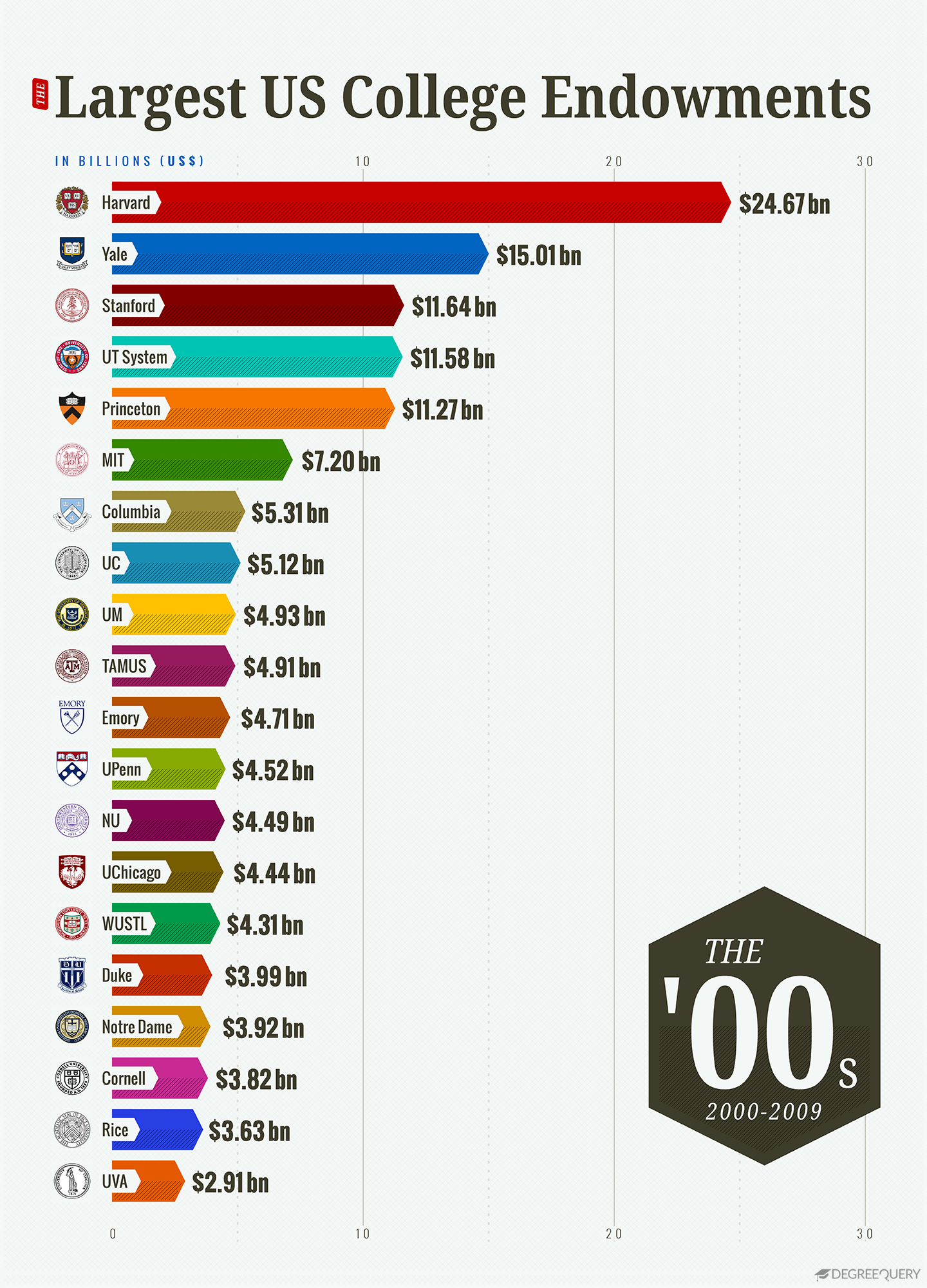

The richest university endowments grew over the last decade, but not as much as they did in the 1990s, according to data compiled by DegreeQuery, which provides research and rankings on higher education.

From 2010 to 2018, the value of the 20 largest endowments grew at an average annual rate of 7.6%, compared to 3.5% from 2000-2009 and 12.5% from 1990-1999.

The biggest movers were the University of Pennsylvania, which rose from 11th to 7th largest, and the Texas A&M University System, which rose from 10th to 8th, according to DeegreeQuery’s data.

In 2017, Harvard University, the perennial leader of the pack, laid off half the staff of its endowment fund and outsourced some operations after lackluster performance, DegreeQuery reported.

More from UB: Higher education giving hits all-time high in 2019

DegreeQuery also cited a NACUBO survey of 810 universities that found that the total market value of endowments in 2018 was $624.3 billion, with 48.3% of that held by just 20 colleges.

“Due to their often wealthy donor base and long-term investment horizons, the largest university endowments can invest in a diverse array of asset classes, and often grow faster than the economy as a whole,” DegreeQuery reported.

More from UB: How four colleges teamed up to buy solar power

But almost all of the Ivy League schools saw subpar returns on their investments last year, according to Chief Investment Officer.

Schools in the Ivy League averaged just 6.7% in fiscal year 2019, which was a strong year for many asset classes. Researchers have blamed the poor performance on individual managers’ uninspiring security selection, Chief Investment Officer reported.

Endowment activism

Meanwhile, Ivy League endowments have been the target of demands from students, faculty and others to divest from various industries.

At Harvard faculty voted in February to call for the university’s $40B-plus endowment to divest from fossil fuels, The Washington Post reported.

“We’re trying to build momentum both within the university and a wider movement,” English Department chairman Nicholas Watson told The Post.

Harvard’s climate-action plan calls for the university to be fossil-fuel free by 2050.

None of the Ivy League schools have so far pledged to divest from fossil fuels, though some, such as Columbia and Yale universities, have partially divested, the Columbia Daily Spectator reported.

More from UB: 5 keys to sustainable purchasing for colleges

Georgetown University has announced that it will stop making investments in companies whose business is fossil fuel-dependent, CNBC reported.

The University of California announced in September said that it was going fossil-fuel free, according to CNBC,

“Our job is to make money for the University of California, and we’re betting we can do that without fossil fuels investments,” the endowment’s chief investment officer, Jagdeep Singh Bachher, and the UC Board of Regents’ Investments Committee chairman, Richard Sherman, wrote in The Los Angeles Times, according to CNBC.“We believe hanging on to fossil fuel assets is a financial risk … While our rationale may not be the moral imperative that many activists embrace, our investment decision-making process leads us to the same result.”

Fundraising trends shift

College advancement and fundraising rank No. 1 for wealthy families looking for causes to support, beating out health, the environment, and arts and culture, University Business reported last month.

A growing number of these families are also speeding up the timeline of their gifts so they can see a quicker impact.

In the past, these families were more focused on leaving a philanthropic legacy, according to a pair of studies just released by Rockefeller Philanthropy Advisors.

Student access to higher education, career readiness, scholarships and faculty support have been among the leading areas philanthropists want to support, with community colleges also receiving increasing focus, says a study released last fall by Rockefeller Philanthropy Advisors and TIAA.