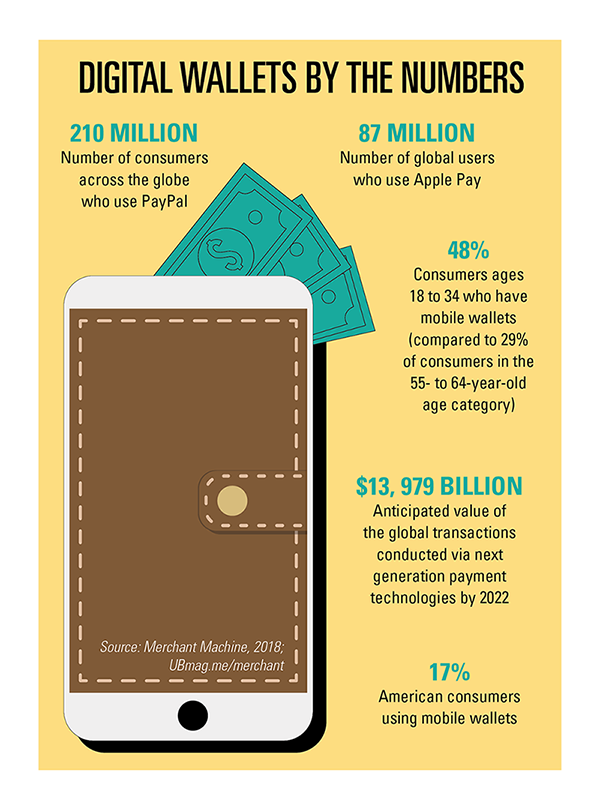

At a growing number of colleges, students buying books or snacks, purchasing tickets to sporting events or even paying tuition can use their digital wallets to complete the transactions. In 2019, an estimated 64 million Americans used their smartphones to make a mobile payment, according to eMarketer research (UBmag.me/emarketer)—and the number continues to climb.

“People are more comfortable doing business online and making electronic payments,” says Vanderbilt University Bursar Chris Cook. “The trend is definitely moving toward digital wallets and online payments.”

At Vanderbilt, more than half of transactions in the bursar’s office are made via electronic payments, and students are increasingly requesting the option to use alternative payment methods (APMs) like PayPal, Venmo, Apple Pay and Google Wallet across campus.

Yet, despite a significant uptick in electronic payments being made by consumers and accepted by businesses, colleges are late adopters. After surveying 1,200 enterprises, a report from ACI Worldwide, an e-payments provider, and the research firm Ovum (UBmag.me/acireport) classified just 29 percent of colleges and universities as “advanced” when it came to accepting APMs.

Here are five areas to consider before allowing students and families to swipe, tap or email their payments.

1. Payment options

The University of Alabama accepts Apple Pay; Indiana University allows students to complete transactions with PayPal and Northwestern University in Illinois takes Venmo. But students who want to use multiple mobile payment services on a single campus might be out of luck—for now.

Leaders at many colleges not yet accepting APMs have such payments on their radar. “There are so many [APMs] and we can’t possibly accept all of them,” Vanderbilt’s Cook says. “Before we decided to say yes to one and no to another, we need to research all of the options.”

2. Processing fees

Just like debit and credit card issuers, some mobile payment services charge processing fees for each transaction.

At Vanderbilt, the bursar passes the cost of processing a credit card transaction on to students; Cook wants to be sure that the transaction fees associated with any accepted APM would either be affordable enough for the school to absorb the cost or on par with processing credit card transactions so students are not paying extra.

3. Integration challenges

Although APMs are designed to make paying easier for customers, the behind-the-scenes efforts to integrate the technologies into existing infrastructure might not be seamless.

“The challenge for those accepting these payment methods is understanding that each is different, may have different requirements and, in some cases, require different technology,” says Adam McDonald, president of TouchNet, the higher ed commerce solution provider.

A unified approach to campus commerce can make it easier for multiple campus departments to integrate disparate third party systems.

4. Security matters

Fraud is a risk: The ACI Worldwide report found that 50% of those in the corporate sector (which included higher education) have had their payment data stolen. That’s why experts suggest rolling out mobile payments in departments that process smaller transactions, including the campus store, dining hall and sporting venues.

Related: Online payments providers offer insight on regulations and pressure to offer nontraditional options

“Most consumers are comfortable with small transactions flowing through APMs,” says Danielle Egr, chief technology officer at Nelnet Business Solutions, another campus commerce systems provider. “Tuition is a big-ticket item and usually people are more comfortable with traditional payment channels for larger purchases.”

5. Return on investment

Introducing digital wallets on campus can help address student demand for more convenient payment options and also provide significant returns to an institution. Cook notes that the move away from cash and checks have created more opportunities for staff in the bursar’s office at Vanderbilt to focus on student support. Having fewer manual payments to provide means staff “are spending less time opening mail and processing data,” he says.

Also read: How to straighten operational efficiency kinks

APMs could also help support fundraising goals. In 2018, iModules, creators of alumni management software, allowed users to start accepting gifts via PayPal, transactions skyrocketed. Their data (UBmag.me/imodules) showed that within six months, 13 percent of online giving transactions were conducted through digital wallets.

As Nelnet’s Egr says, “Institutions want to meet their consumers where they are and payment choice is one of those areas.”

Jodi Helmer is a North Carolina-based writer and frequent contributor to UB.