Return on investment, or ROI, is all the rage in higher education as students and a skeptical public question the cost of going to postsecondary school. However, how we talk about the value of a college credential may be just as important as the metric itself.

The Center on Education and the Workforce at Georgetown University has updated its database capturing median net returns on a college education up to 40 years after a student’s initial full-time enrollment. The exhaustive list ranks about 4,600 schools across the private, public and for-profit sectors and by the predominant credential they offer.

The ROI of an institution was calculated by adding students’ median earnings six to 10 years after they first enrolled, minus the average net price paid, figures which it captured from the Department of Education’s College Scorecard. Variables not accounted for in the study include the average out-of-pocket cost for out-of-state students, their accrued college debt and the outcomes of students who don’t receive federal financial aid.

It’s important to note that the ROI estimates past the 10-year mark are conservative. Researchers at the Center on Education and the Workforce assumed no growth in earnings after year 10 despite a typical salary increase, according to the FAQ.

More from UB: Student visas are now being revoked by the hundreds

Here are some of the most eye-catching findings about ROI, which may force you to question how you frame the value of a credential.

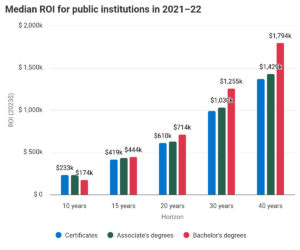

Certificates and associate degrees offer short-term wins—but bachelor’s degrees offer higher earnings in the long run

The median 10-year return on investment on a certificate and associate’s degree is greater than a bachelor’s degree across every institution type. The net gain from a certificate earned at a public college was $59,000 more than a bachelor’s degree in this period.

Things begin to change after the first decade.

The ROI from a bachelor’s degree earned at a public college eclipses an associate’s degree and certificate 15 years after students’ initial enrollment. The value of the four-year degree exponentially expands from there, offering a net gain of at least $250,000 over an associate degree 30 years removed from postsecondary enrollment.

The shift stems from the additional time and cost a bachelor’s degree demands compared to degrees that allow students to enter the workforce quickly. When observed beyond the first decade, the cost and time commitment of earning a bachelor’s degree shrinks while earnings grow.

The ROI of a bachelor’s degree edges out other credentials 20 years afterward at private nonprofits and 30 years afterward at for-profit institutions.

Graduation rates for bachelor’s degrees positively impact ROI—but acceptance rates don’t

Graduation rates positively correlate with students’ 10-year and 40-year ROI from attending a postsecondary institution if they earned a bachelor’s degree. On the other hand, the correlation between graduating and ROI was more scattershot for certificates and associate degrees.

Acceptance rates negatively correlated with ROI across every credential and institution type. The correlations are highest for private nonprofit institutions, particularly those that predominantly offer associate degrees.

ROI isn’t the whole picture

While ROI is a significant consideration when choosing an institution, prospective students should also weigh many other factors, the FAQ reads.

“Students also will want to think about whether an institution offers the program of study that they want, for example, as well as the institution’s cost, location, instructional delivery method (in-person, online, or hybrid), and whether they are likely to be admitted.”