Higher education fraud and embezzlement originating from any corner of campus can threaten any college or university. The losses can be big, which is why fraud protection is necessary.

A former Connecticut College employee was sentenced to 18 months in prison this spring for various embezzlement schemes totaling $173,010, including diverting checks for the college and money from the campus card program to bank accounts he controlled.

It’s just one example of how employee fraud is an issue in higher ed. Yet many universities don’t deploy very sophisticated defenses against fraud.

Related: 8 ways to deter and detect campus fraud

Institutional teams—executive-level and academic leaders, not just finance administrators—must understand the prevalence of the employee higher education fraud problem.

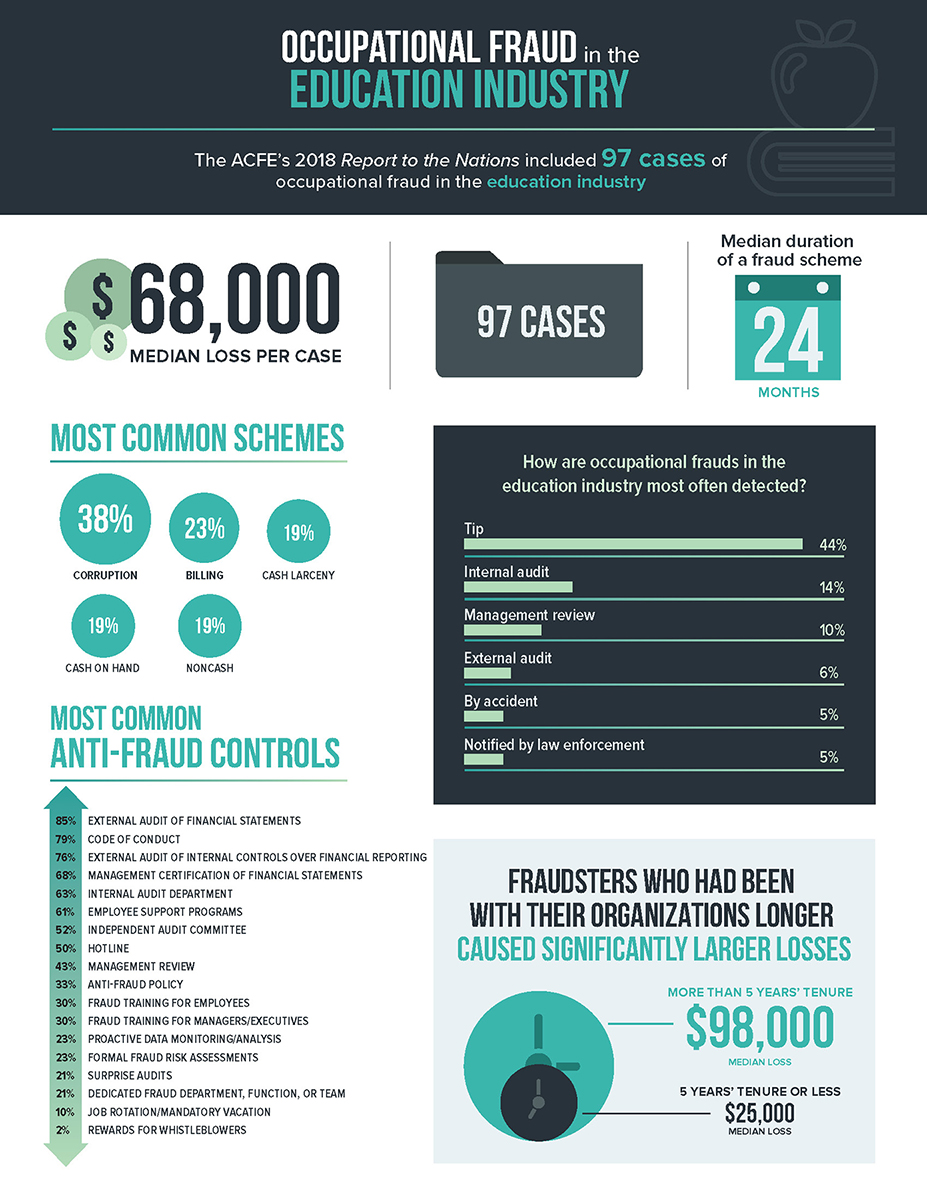

Ninety-seven cases of occupational fraud in the education industry were included in the Association of Certified Fraud Examiners’ 2018 “Report to the Nations,” with a median loss of $68,000 median per case. The most common schemes involved corruption or billing, and the greatest percentage of education industry frauds (44%) got detected because of a tip. Just 14% were detected by an internal audit and 10% by management review, the next most common methods of detection. (See graphic below for more stats.)

Here are four fraud protection strategies to prevent and detect embezzlement or other financial misdoings.

1. Transactional analysis software

1. Transactional analysis software

This form of data analysis software detects unusual patterns in transactional information. Some vendors, such as ACL and LogRhythm, now market these products specifically to higher ed. The systems can alert staff to possible fraudulent activity by identifying anomalies in records of financial transactions. Then, human follow-up can determine if something unethical is going on or if it’s just a deviation such as a missing approval for an otherwise routine transaction.

2. Internal financial controls

Controls, a basic part of the anti-fraud toolbox, should include adequate separation of duties, as well as effective internal audit procedures such as surprise internal audits.

But the typical level of controls—such as ensuring that staff always adhere to approval protocols and that the people who deposit money are not also responsible for reconciling the account—may not be sufficient defense against crafty employees who know enough about internal systems to circumvent them. So officials should analyze the effectiveness of existing controls and then proactively strengthen them where needed.

Staff training and consistently applying existing controls are also effective higher education fraud protection strategies. Think of the effort as involving both blocking and tackling.

3. Potential fraud investigations

3. Potential fraud investigations

Insiders, from support staff to senior administrators, often know enough to convince themselves that even the best security procedures can be defeated.

Investigation becomes necessary once such an incident has been detected, or simply suspected. One common response is supplementing analytics with consulting or other services. For example, a team of CPAs and certified fraud examiners could do a forensics accounting analysis, reviewing areas where schemes are suspected or where there are exploitable weaknesses.

If fraud is detected, the forensics team helps provide the necessary proof for calling in law enforcement or taking steps to recoup losses. If not (whew!), a fraud protection report could provide recommendations for tightening security.

Fraud resources

“Fraud Red Flags,” Wayne State University, Office of Internal Audit

“The Fraud Curve: White-Collar Crime In Higher Education,” Association of Certified Fraud Examiners

4. Visibility

A high level of visibility can also work against higher education fraud. Experts suggest promoting anti-fraud efforts and a hotline to report possible fraud activity across campus via memos from top-level administrators or webpage announcements.

The University of Texas at Austin maintains a hotline through its office of internal audits so anyone who suspects fraudulent activity may report it toll-free. Alternative reporting avenues include a web-based form, standard mail, email and office phone. Anonymity is also an option.

Others institutions offering similar hotlines include The University of Georgia, Alcorn State University in Mississippi and North Dakota State University.

Every incident that is prevented represents one less costly, and perhaps embarrassing, problem that would otherwise take administrators off-mission.

Mark Rowh is a Virginia-based writer; Melissa Ezarik is senior managing editor of UB.

Interested in technology? Keep up with the UB Tech® conference.